Exploring Health Plans: Self-Funded vs. Fully Insured Options for Employers

Exploring Health Plans: Self-funded, Fully Insured & More

Over the past two decades, I’ve witnessed the transformative impact that informed healthcare choices can have on businesses. My experience spans both fully insured and self-funded plans, and I’ve made it my mission to help organizations take control of their healthcare costs while enhancing employee benefits. With rising healthcare costs, understanding these plan types is crucial for any employer navigating the world of health insurance.

Understanding Fully Insured Plans

A fully insured plan is one of the most common types of health insurance arrangements. In this model, employers pay a fixed premium to an insurance carrier, which then assumes the financial risk of covering employee healthcare costs. Imagine it like renting a car with full insurance—the employer pays a predetermined amount, and the insurance company handles all the costs if something goes wrong.

While this structure provides predictability in monthly expenses, it may come with higher long-term costs. This predictability simplifies budgeting for employers, but it also reduces flexibility and control over healthcare spending.

The Mechanics of Fully Insured Plans

In a fully insured plan, the employer pays monthly premiums to an insurer who then takes on the responsibility of processing claims and paying healthcare providers. This setup makes healthcare administration easier for the employer, as they are essentially outsourcing a critical aspect of employee benefits. However, employers also give up control, which can limit their ability to tailor the plan to their specific workforce’s needs.

Exploring Self-Funded Plans

On the other side of the spectrum, self-funded insurance puts the employer in the role of the insurer, assuming financial responsibility for their employees’ healthcare costs. Instead of paying premiums to an insurance carrier, employers set aside funds specifically for covering healthcare expenses. This approach allows for more customization and control over the plan but introduces a higher degree of financial risk.

A self-funded plan offers potential cost savings but also requires a strategic approach to manage effectively. Employers have direct oversight of healthcare spending, which can lead to cost-effective adjustments based on the unique needs of their employees.

Deconstructing Self-Funded Plan Components

A self-funded plan includes several critical components, each essential for smooth operation:

- Third-Party Administrator (TPA) – A TPA manages plan administration, including claims processing, provider networks, and customer service. By handling daily operations, the TPA ensures efficient and accurate management of the self-funded plan.

- Pharmacy Benefits – Pharmacy Benefit Managers (PBMs) often manage this aspect, negotiating drug prices and overseeing prescription drug programs on the employer’s behalf. This allows the employer to leverage the PBM’s expertise and negotiate better drug prices.

- Stop-Loss Insurance – Acting as a safety net, stop-loss insurance kicks in when claims exceed a set limit, protecting the employer from exceptionally high expenses. This coverage is crucial for managing financial risk in a self-funded model, offering peace of mind while maintaining control over most healthcare spending.

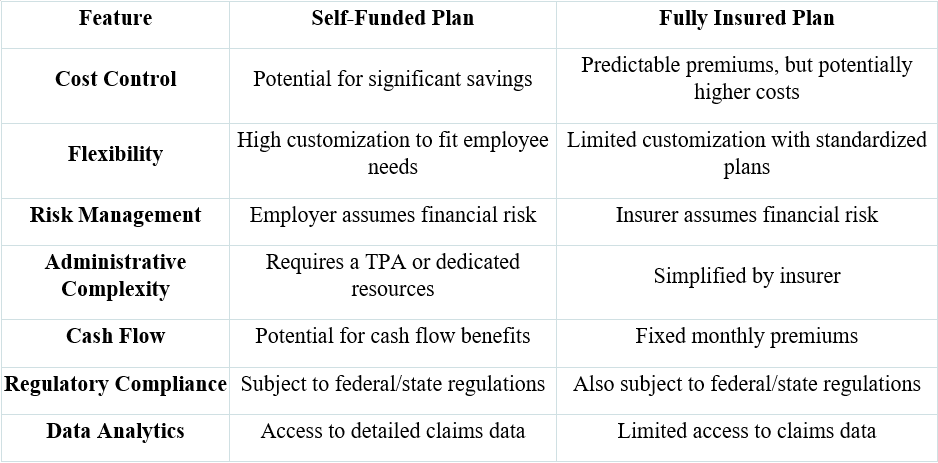

Self-Funded Plan vs. Fully Insured Plan: Making the Right Choice

Choosing between a self-funded and fully insured plan depends on your organization’s needs, resources, and risk tolerance. Both options come with their unique benefits and challenges. In a fully insured plan, the insurer has control, whereas in a self-funded plan, the employer holds the reins, leading to potential cost savings but also higher responsibility.

Pros and Cons: Weighing the Options

Evaluating the pros and cons of each plan type helps in making an informed choice that aligns with your organization’s goals.

Each organization should assess these factors based on its financial stability, workforce demographics, and long-term benefits goals.

Considering self-funding?

Reach out to Triforta to explore how it can benefit your business.

Mastering Health Insurance, Employer Benefits, Medical Premiums, and Claims Processing

Effective health insurance management requires a strategic approach that aligns with both the employer’s budget and the needs of employees. Understanding the basics—like medical premiums and how they’re calculated—is essential.

Medical premiums represent payments made to an insurer or into a self-funded plan’s trust to cover healthcare costs. Whether in a fully insured or self-funded plan, these premiums play a pivotal role in managing cash flow and budgeting for healthcare expenses.

Claims Processing Under a Microscope

Claims processing is the backbone of any health plan. In a fully insured setup, insurers handle claims processing, taking a hands-off approach for the employer. In self-funded plans, however, the employer—often through a TPA—manages the claims process directly. Efficient claims processing is crucial for employee satisfaction, as it ensures accurate and timely provider payments, minimizing financial hassles for employees.

Conclusion

Navigating the world of employer health plans—whether self-funded, fully insured, or a combination—can initially seem overwhelming. But understanding the structure, costs, and benefits of each option empowers employers to make informed decisions that support long-term health and financial goals.

The choice between self-funded and fully insured plans ultimately hinges on your organization’s risk tolerance, resources, and commitment to a proactive benefits strategy. Self-funding, while requiring more involvement, often offers flexibility, cost savings, and greater access to claims data that can drive smarter decisions.

Want to optimize your employee benefits program?

Contact Triforta to find a healthcare solution that aligns with your company’s goals.