What the OBBB Act Means for Your 2025 Employee Benefits Strategy

As an HR or benefits professional, staying ahead of the curve isn’t just a nice-to-have, it’s mission-critical. From legislative updates to shifting employee needs, your role in shaping competitive, attractive benefit packages is more important than ever.

The recently passed One Big Beautiful Bill Act (OBBB) is the biggest overhaul to employee benefits in years. Inside, you’ll find major updates that affect Health Savings Accounts (HSAs), Dependent Care FSAs, student loan assistance, and even entirely new benefit options.

Let’s break down what changed, and what it means for your workforce.

Major HSA Updates Every Employer Should Know

HSAs have long been a staple of benefits strategy for high-deductible health plans. With their triple-tax advantage, they’re both employee- and employer-friendly.

The OBBB introduces three big changes to HSAs that could reshape how you structure your health benefits.

Telehealth Coverage Is Now Permanent

Temporary COVID-era rules allowing pre-deductible telehealth coverage are now permanent for HSA-qualified plans. This is a win for remote and hybrid teams, allowing virtual care access without impacting HSA eligibility.

HR Tip: Promote virtual care benefits in onboarding and open enrollment materials. It enhances access to care and supports employee well-being.

More Health Plans Qualify for HSAs

All Bronze and Catastrophic plans sold through ACA exchanges now qualify as HDHPs. This expands HSA eligibility to millions and makes your benefit offering more compatible with employees’ existing plans.

Triforta Insight: We can help your team evaluate whether your current health plans align with modern HSA standards.

Direct Primary Care (DPC) Now HSA-Compatible

DPC models, flat-fee, subscription-based care, are officially greenlit. Starting in 2026, employees can pay for DPC memberships with tax-free HSA funds.

Dependent Care FSA Boost Brings Relief for Working Parents

DCFSA contribution limits are increasing for the first time in decades, from $5,000 to $7,500 in 2026. This is long-overdue support for employees facing rising childcare costs.

Employer Action Item: Work with your FSA administrator to update cafeteria plan documents and notify employees during annual enrollment.

Student Loan Repayment: A Permanent Tax-Free Benefit

Originally temporary under the CARES Act, employers can now offer up to $5,250/year in tax-free student loan assistance, permanently. Indexed for inflation starting in 2026, this benefit is now a long-term recruitment and retention tool.

"Trump Accounts": A New Long-Term Savings Vehicle

Employers can now contribute up to $2,500 annually to an employee’s “Trump Account”, a new tax-advantaged savings account. These accounts support long-term financial wellness and can be extended to employees’ dependents. Consider this option as a supplement to retirement or college savings benefits.

A Farewell to Bicycle Commuting Reimbursement

A small but symbolic change: the qualified bicycle commuting benefit will not be reinstated in 2026. Employers can still support cyclists through wellness stipends or taxable bonuses.

What Didn’t Make It Into the Final Bill?

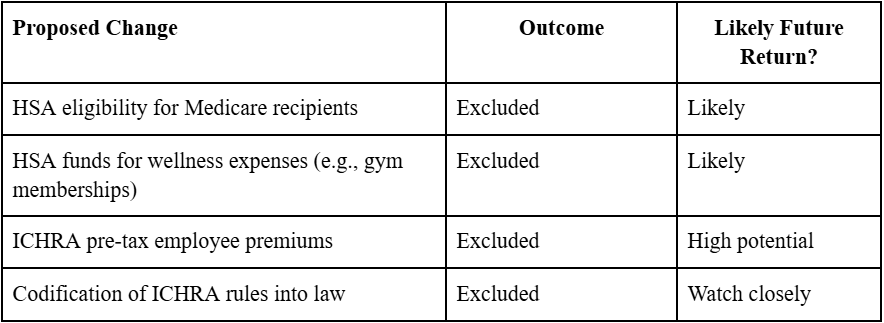

Several popular proposals were excluded from the final OBBB:

Stay alert to future HSA and ICHRA reforms, these could dramatically expand benefit design flexibility.

Building Your Benefits Strategy Post-OBBB

This bill reshapes how benefits professionals should approach plan design and employee communications:

- Review: Reassess your current HSA-eligible plans and dependent care offerings.

- Update: Prepare to amend plan documents and align with upcoming 2026 changes.

- Communicate: Educate employees on the new benefits available to them, especially student loan support and telehealth updates.

Adapt: Consider emerging options like Trump Accounts as part of your total rewards strategy.

Explore how Triforta simplifies benefits administration: From HSA-compatible plans to integrated compliance support, we help HR teams deliver value without complexity.

Conclusion

The OBBB is more than just legislation, it’s a roadmap for modernizing your employee benefits strategy. With permanent telehealth support, higher FSAs, long-term student loan help, and new savings accounts, you now have more tools than ever to support your workforce.

But understanding the law is only step one. Implementation, education, and strategic positioning are where the real work begins. At Triforta, we help HR leaders deliver benefits that matter, without the guesswork.

Ready to simplify your employee benefits strategy?

Let’s talk